Could this increase have been

lower?

In short, the answer is not without significant impact on services and reduction in maintenance standards throughout the village.

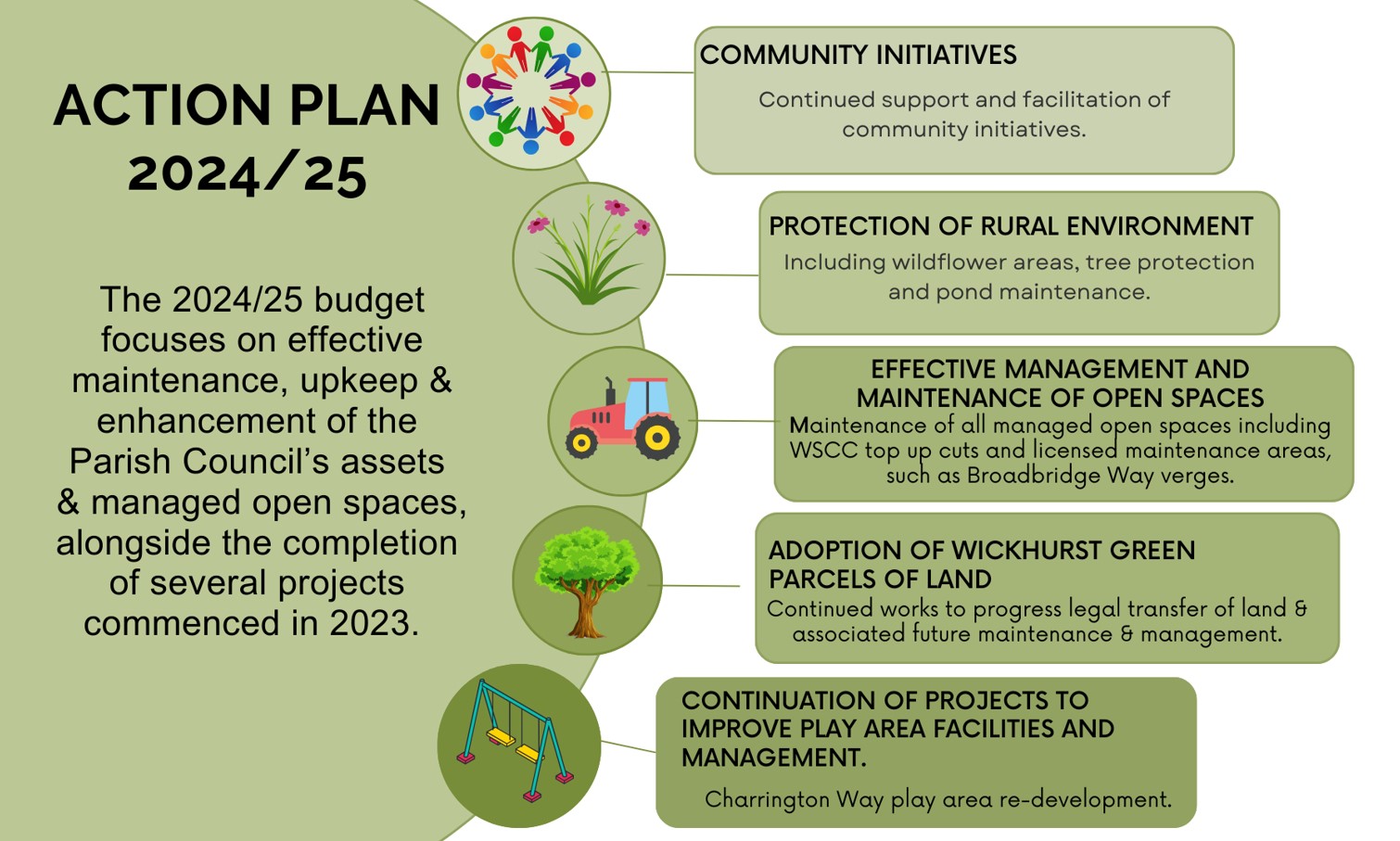

The Parish Council will focus on its Action Plan as demonstrated below whilst meeting its various statutory requirements.

Where does your precept go?

The Parish Council has maintenance responsibilities for a number of areas within Broadbridge Heath, which can be identified on an interactive map.

These areas include the Weston Avenue Allotments, 4 play areas, The Common, BBH Cricket Ground, BBH Tennis Club courts, and numerous open spaces. The Council pay the district authority for refuse collection in our open spaces.

The Parish Council is actively pursuing the legal adoption of the Allotment site, 2 play areas, and various open spaces on the Wickhurst Green development. We hope to achieve completion of these transfers in the near future.

West Sussex County Council maintain the verges on County adopted roads and the Parish Council top-up these cuts around the village to keep them well maintained.

As with most service providers and businesses, administration is the biggest cost – this includes a wide range of expenditure such as staffing, IT and infrastructure, legal, audit and insurance costs etc. There is a plan to increase staffing resource this year to help with maintenance and facilitate with issues that arise in the village that are currently sometimes outsourced. It is anticipated that this additional resource will bring efficiency to the Parish Council whilst providing an overall cost saving for maintenance.

The Parish Office, which was transferred from the developer of the Wickhurst Green Estate, has provided a place of work for the staff and a space for developing community initiatives.

All Parish Council and Committee meetings take place at the Parish Office, to which members of the public are always welcome.

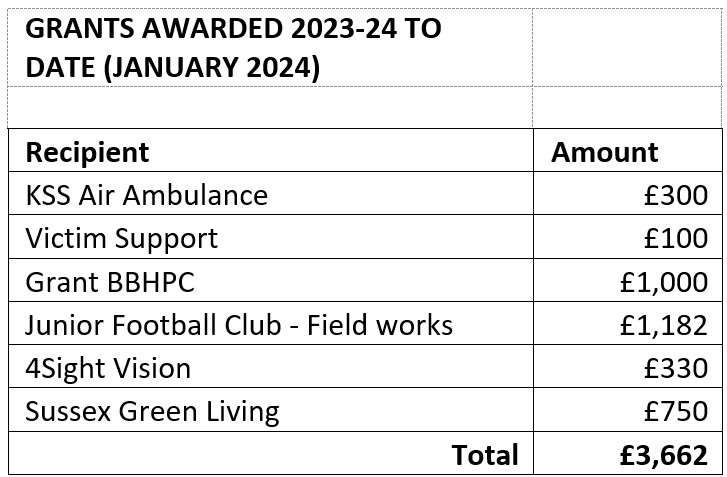

The Parish Council invites local organisations to apply for Grant Funding to support our community. The below table shows the grants awarded to date for this financial year.

In addition to this in the past year BBHPC has provided funding for 4theYouth (weekly Youth Club and Mobile Community Hub) and the Age UK Village Agent.

How does our Precept compare with District and National Average

Our Band D contribution in 2023/24 was £59.07. The district average for the same year for Band D was £74.46, and the national average was £79.35.

If you have any further questions or queries please email: admin@broadbridgeheath-pc.gov.uk